Discover how MCP + Tali, the AI Co-Pilot of cofi.ai, give PE real-time, forward-looking portfolio intelligence—predicting risks, spotting trends early, and accelerating value creation.

AI-Driven Financial Ops: How MCP Unlocks Real-Time, Forward-Looking Portfolio Answers

Discover how MCP + Tali, the AI Co-Pilot of cofi.ai, give PE real-time, forward-looking portfolio intelligence—predicting risks, spotting trends early, and accelerating value creation.

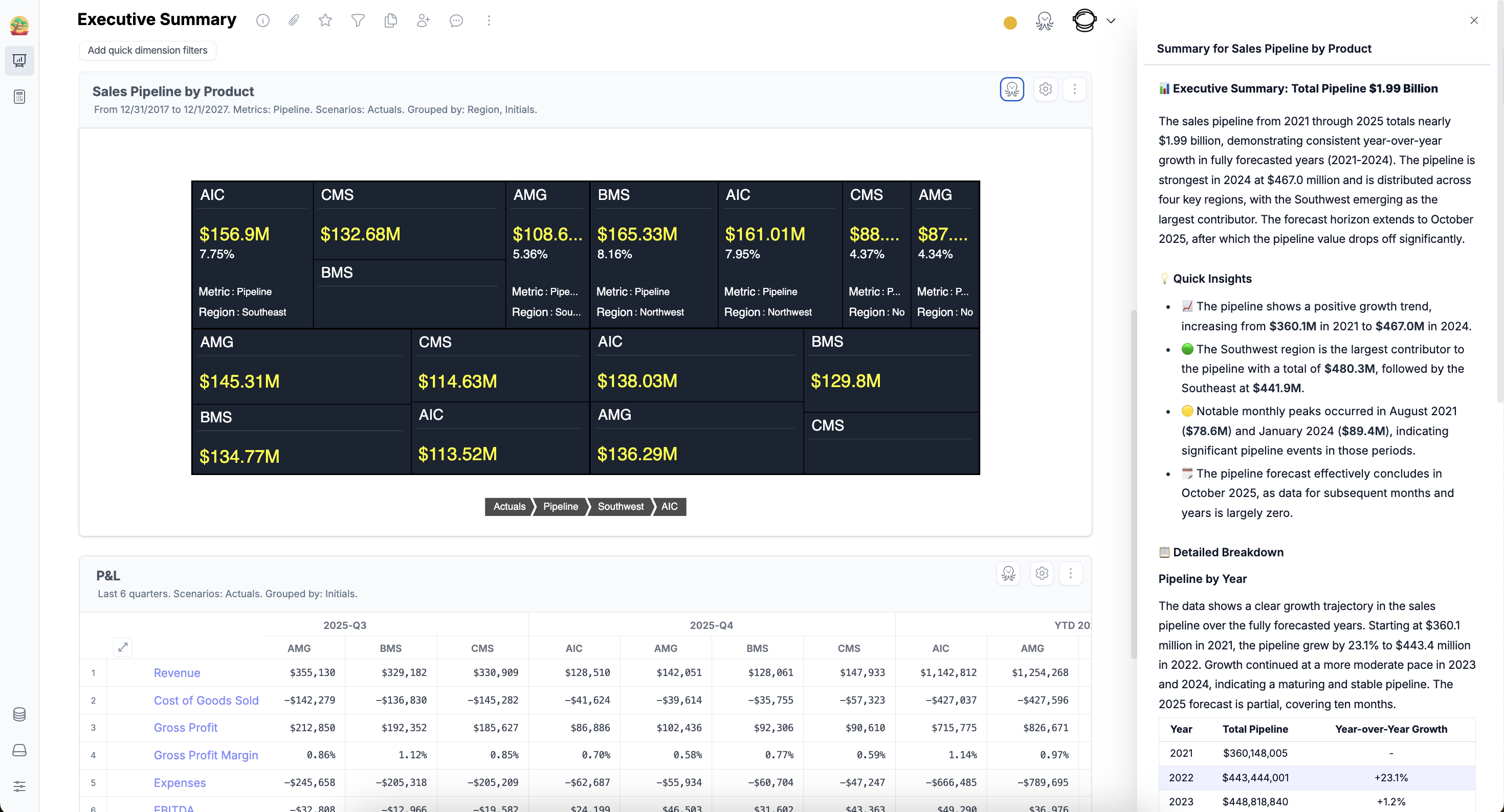

Download NowWatch NowPrivate equity doesn’t struggle with reporting — it struggles with seeing what’s about to happen. The quiet shifts inside each portco — margin drift, stalled pipeline, creeping burn — don’t show up in dashboards until it’s too late. That’s the real gap between thesis and value creation.

cofi.ai + Tali close that gap by turning portfolio data into forward-looking intelligence. With governed data and MCP, firms can ask a question and get real-time trend detection, anomaly alerts, and early insights that surface risks and opportunities weeks before manual reporting. This isn’t more dashboards — it’s the ability to anticipate, intervene, and create value faster.

What is Model Context Protocol — and Why It Matters for PE?

Model Context Protocol (MCP) is an open standard that lets AI systems communicate securely with real financial and operational data — without that data ever leaving your environment.

Think of it as a trusted interpreter between:

- Your financial and operations engine (cofi.ai)

- Your LLM (OpenAI, Anthropic, Mistral, or your in-house model)

- Your governed data (ERP, CRM, HRIS, Excel, operational KPIs)

With MCP, the AI doesn’t guess. It pulls only from the approved, audited, normalized data inside cofi.ai.

When someone asks: “Which companies are pacing behind plan this week — and what’s driving it?”

They get an answer fromreal portfolio data, not an AI hallucination.

Who Benefits — and How

Fund Leadership & Managing Partners

Leaders don’t have time for dashboard archaeology. With MCP, they instantly see:

- “Which companies have early signs of margin erosion?”

- “Where is burn accelerating faster than forecast?”

- “Which revenue segments are softening across the portfolio?”

Instead of waiting for quarterly reviews, leaders get real-time deviations.

Operating Partners

Ops teams spend hours cutting across:

- different systems

- different definitions

- different reporting cadences

Tali now answers questions that previously required days of Excel:

- “Compare sales velocity across all B2B SaaS companies.”

- “Show week-over-week changes in pipeline coverage.”

- “Flag anomalies in COGS trends across our manufacturing portcos.”

This is portfolio intelligence without manual effort.

Portfolio Company CFOs & Controllers

Portco teams finally see the same truth as the fund — without duplicating effort.

They ask:

- “Are we trending ahead or behind fund-level gross margin expectations?”

- “Why did cash collections slow this week?”

- “Which customer segment is driving churn?”

Insights happen at the speed of the business.

Investment Committees

IC members can instantly retrieve institutional knowledge:

- “How did our last three investments in vertical SaaS trend in their first 12 months?”

- “What revenue multiples did we achieve at last five exits in B2B services?”

That’s weeks of analysis available in seconds.

Why MCP + cofi.ai Is a Breakthrough for PE Infrastructure

1. Real-Time, Portfolio-Wide Insight

No more waiting for consolidated reports or monthly close. Tali continuously surfaces patterns like:

- A subtle rise in discounting across a sales team

- Labor cost creep in a distribution business

- Slower renewal cycles inside one customer segment

- A widening inventory variance

- Cash burn accelerating ahead of plan

Signals operators never see in dashboards until it’s too late.

2. Democratized Financial Intelligence

Everyone who should see the data — can. No SQL. No BI complexity. No “where does this metric live?”

The portfolio becomes conversational.

3. Consistency and Control

MCP queries run only on governed cofi.ai data:

- standardized

- normalized

- permissioned

- auditable

You get trust, not speculation.

4. Secure by Design

A common misconception:

“MCP gives AI too much access.”

Reality:

MCP limits and governs access with precision.

It enforces:

- strict rules

- structured data exposure

- transparent audit trails

- zero data exfiltration

Your LLM never sees anything it shouldn’t.

How MCP Improves Over Dashboards, Reports, and Excel

MCP vs. Dashboards

Dashboards show what happened. Tali explains why — and what may happen next.

MCP vs. Report Requests

Forget waiting on analysts or SQL. You get answers immediately — with visualizations.

MCP vs. Excel

No more stitching CSVs together, reconciling columns, or version control nightmares. Insights are real-time and error-free.

Real Portfolio Scenarios — Now Automated

Scenario 1: Operational Drift Detection

“Identify any companies with margin erosion in the last 14 days. Explain the drivers.”

Tali surfaces:

- SKU-level cost shifts

- overtime labor spikes

- unexpected discounting

- rising COGS hidden in supplier variability

Insights humans miss until quarter-end.

Scenario 2: Cash Runway Protection

“Which portcos will drop below 9 months of runway based on current burn and revenue trends?”

Tali analyzes:

- weekly burn

- forecast trajectories

- hiring velocity

- collections pace

Turn reactive finance into proactive planning.

Scenario 3: Value Creation Execution

“Show me which companies are off-plan on their 100-day value creation KPIs.”

Tali correlates:

- planned initiatives

- operational metrics

- workflow execution

- forecast impact

This is real-time VCP accountability.

Advanced Use Cases (Where PE Gains a Competitive Edge)

Multi-Entity Benchmarking

Compare your own SaaS companies, B2B service companies, or manufacturing companies against each other — automatically.

Dynamic Scenario Modeling

“What if three portcos hit upside cases while two miss by 20%? Show fund-level IRR impact.”

Automated Deal & Exit Intelligence

Tali retrieves historical patterns instantly:

- performance trajectories

- retention curves

- margin expansion

- efficiency benchmarks

Institutional memory becomes searchable.

Best Practices for Getting the Most from MCP

- Ask with clear timeframes

- Request charts when helpful

- Specify metrics

- Ask for recommendations

- Use follow-up questions

- Ask Tali to check for data quality issues

Implementation Notes (Fast, Light, Secure)

- Setup takes minutes

- Permissions remain controlled in cofi.ai

- Data stays inside your environment

- Queries use real-time, not stale, data

Where This Is Going Next

We’re entering the era of autonomous portfolio intelligence:

- anomaly detection

- proactive alerts

- recommended interventions

- draft investment memos

- scenario stress-testing

- automated forecasting refinements

Tali is evolving into the Portfolio Intelligence Operating System — combining:

- consolidated governed data

- AI reasoning

- MCP secure orchestration

- portfolio-wide context

The firms adopting this now will outpace those relying on quarterly hindsight.

Ready to See It Live?

If you want to see how conversational insights, anomaly detection, and portfolio-wide intelligence operate in real time, the cofi.ai team can walk you through it.

The future of PE financial intelligence isn’t dashboards. It’s dialogue. And it’s already here.

Let's connect. Click here to schedule a call with us.

.png)